1. 🚀 The Millennial Money Mindset in 2025

From YOLO to Long-Term Wealth

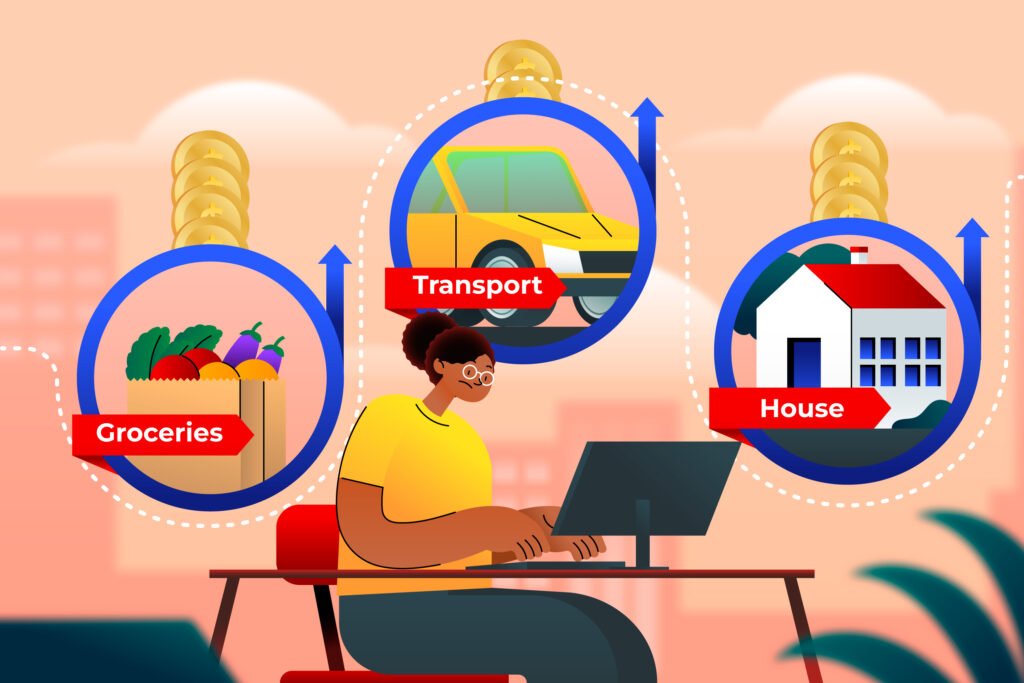

In the past, many millennials embraced the “YOLO” (You Only Live Once) philosophy—focusing on experiences, spending, and living in the moment. But by 2025, there’s a noticeable shift. Today’s millennials are more focused on long-term financial security, early retirement goals, and wealth accumulation. The pandemic, inflation, and economic volatility have sparked a mindset shift toward future-proofing life, not just enjoying the now.

Tech-Savvy, But Risk-Aware

Millennials are arguably the most tech-empowered generation, with investing apps, robo-advisors, and digital wallets at their fingertips. But access to tools hasn’t made them reckless. Instead, they’re more cautious, balancing convenience with risk management. Rather than gambling on high-risk trades or volatile markets, many prefer structured, automated systems—like Systematic Investment Plans (SIPs)—that align with their risk appetite and long-term vision.

Why Passive Income Is the New Goal

Owning assets that earn while you sleep is no longer just a dream. It’s a strategy. With job markets evolving and side hustles becoming common, millennials are now chasing passive income streams—and SIPs offer just that. By building a disciplined, consistent investment habit, they aim to create future income that doesn’t depend on daily hustle. For many, SIPs are the foundation of financial independence.

2. 💡 SIP 101: What Millennials Need to Know

What Is a SIP and How Does It Work?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly—usually monthly—into a mutual fund scheme. Instead of making a one-time investment, you commit to consistent contributions, allowing your investment to grow over time through rupee cost averaging and compounding. It’s simple, automated, and stress-free—making it ideal for beginners or busy millennials who want to grow their wealth without daily market tracking.

Mutual Funds vs. Other Investment Avenues

Mutual funds pool money from various investors to invest in a diversified portfolio of stocks, bonds, or other securities—managed by professional fund managers. Compared to direct stock trading, mutual funds offer lower risk, expert guidance, and greater diversification. While crypto, forex, and NFTs may seem exciting, SIPs in mutual funds offer regulated, transparent, and time-tested returns over the long run. For millennials, that’s a smart trade-off: stability over speculation.

Why SIPs Fit the Monthly Budget Model

One of the biggest perks of SIPs? They sync perfectly with salaried life. You don’t need a lump sum—just ₹500 or ₹1,000 per month is enough to start. Millennials juggling EMIs, rent, and lifestyle costs appreciate the flexibility SIPs offer. It’s an investment plan that adapts to your income cycle, not the other way around. You can increase, pause, or modify your SIPs as your financial situation evolves.

3. 📈 Why SIPs Are Still Beating the Hype in 2025

Rupee Cost Averaging: A Game-Changer

Markets go up and down—but with SIPs, that volatility becomes your ally. Thanks to rupee cost averaging, you automatically buy more units when prices are low and fewer when prices are high. Over time, this strategy reduces your average purchase cost, helping you build wealth more efficiently than trying to time the market. For millennials without the time or expertise to analyze stock charts, this passive strategy delivers steady returns with minimal effort.

Power of Compounding in a High-Inflation Economy

2025 continues to challenge savers with rising living costs. But SIPs offer a powerful antidote: compound growth. By reinvesting returns and adding monthly contributions, your money grows exponentially over time. In an economy where inflation eats into savings, SIPs help your wealth outpace inflation, protecting purchasing power and creating real growth. Starting early—even with a small amount—gives millennials a massive edge over waiting for the “right time.”

Consistency Over Timing the Market

Let’s face it—most people aren’t great at predicting market highs and lows. And millennials know this. That’s why many now favor SIPs, which remove the stress and guesswork. The key to long-term returns isn’t when you invest, but how consistently you do it. Whether markets are soaring or crashing, your SIP keeps going—building discipline and long-term wealth, no matter the market mood.

4. 🔄 Automation Meets Investment

How Fintech Apps Simplify SIPs

In 2025, investing is no longer a banker’s game—it’s in your pocket. With a surge in fintech apps and investment platforms, starting a SIP takes less than five minutes. Millennials can research funds, set goals, schedule auto-debits, and monitor performance—all from their smartphones. These tools also offer AI-powered recommendations, portfolio rebalancing, and real-time alerts, making SIP investing as easy as managing a playlist.

Auto-Debit, Portfolio Trackers & Instant Switches

Once a SIP is set up, automation takes over. Monthly auto-debits ensure you never miss an installment, while portfolio trackers give you instant snapshots of your performance. Need to change your fund? Many platforms now support instant switches, letting you shift investments with a tap. This frictionless experience keeps investing consistent, transparent, and in sync with your evolving financial goals.

Set It and Forget It—Millennial-Style

The best part about SIPs in 2025? You don’t have to babysit them. The “set it and forget it” approach resonates deeply with millennials juggling careers, side hustles, and personal goals. With SIPs, the work happens in the background, quietly building wealth while you focus on life. And with regular reviews and alerts built into apps, you’re always in control—without being hands-on every day.

5. 🧠 Psychology of SIPs: Why Millennials Stick to It

Small Starts, Big Impact = Less Anxiety

Many millennials hesitate to invest due to fear of losing money or not having “enough” to start. SIPs eliminate that stress. With entry points as low as ₹500 per month, they offer a low-risk, low-pressure way to begin. Watching small contributions turn into meaningful wealth over time boosts confidence and reduces the fear of making a “wrong” move. It’s the psychological safety net that keeps investors committed.

Monthly Investing Aligns with Paycheck Lifestyle

Millennials are budgeting pros—tracking expenses, EMIs, and subscriptions every month. SIPs fit perfectly into this rhythm. Rather than demanding a large lump-sum, they mirror the monthly flow of income and expenses. This alignment makes SIPs feel less like a sacrifice and more like a habit, seamlessly integrating with existing financial routines.

Goal-Based Investing Keeps Motivation High

Whether it’s buying a home, traveling the world, or retiring early, millennials love attaching meaning to their money. SIPs make this possible through goal-based investing. Most apps now let users tag SIPs with specific goals—creating a direct link between today’s actions and tomorrow’s dreams. This clarity transforms saving into something motivating, not monotonous, helping investors stay consistent even during market dips.

6. 🌍 SIPs and Sustainability: The Rise of ESG Funds

Investing With Purpose

Millennials in 2025 aren’t just investing for returns—they’re investing for impact. Many want their money to reflect their values: sustainability, ethical practices, and social responsibility. That’s where ESG (Environmental, Social, and Governance) funds come in. SIPs now allow millennials to put their money into companies that are not only profitable but also responsible—offering a way to build wealth without compromising beliefs.

ESG SIPs for the Socially Conscious

With rising awareness around climate change, corporate ethics, and diversity, ESG-focused mutual funds have gained traction. SIPs into these funds mean your monthly contributions support companies that prioritize clean energy, ethical labor practices, and transparent governance. For millennials, this creates a feel-good investment cycle—earning returns while driving positive change.

Balancing Wealth and World

ESG SIPs strike a rare balance: financial growth + global good. They give millennials a way to support the kind of future they want to live in—without sacrificing performance. In fact, many ESG funds have shown strong returns in recent years, proving that doing the right thing can also be financially rewarding. For the values-driven investor, this is a win-win.

7. 📊 SIPs vs. New-Age Trends (Crypto, NFTs, Trading Apps)

Why SIPs Still Win on Stability

In an age of high-volatility assets like crypto and meme stocks, SIPs offer something rare: predictable progress. While flashy investments promise quick gains, they often come with sleepless nights and sudden crashes. SIPs, on the other hand, are boring by design—and that’s a good thing. They provide steady, regulated, long-term exposure to the market with far less emotional turmoil. For millennials seeking financial peace of mind, SIPs are still the safer bet.

Market Noise vs. Long-Term Signals

Social media is full of hype—“buy this altcoin,” “flip that NFT,” “trade this breakout.” It’s noisy, fast, and overwhelming. SIPs cut through that chaos. They focus on fundamentals and long-term growth, not trends or hot takes. While day traders react to the hour-to-hour buzz, SIP investors stay focused on goals, compounding, and wealth building—ignoring the daily drama in favor of future results.

The “Boring” Strategy That Works

In 2025, many millennials are learning that boring works. SIPs don’t offer moonshot returns overnight—but they do offer something far better: consistent growth, minimized risk, and financial discipline. The thrill of a crypto rally is short-lived; the satisfaction of hitting your retirement goal through disciplined SIP investing lasts a lifetime. Sometimes, boring is the smartest strategy in the room.

8. 🏡 Real-Life Examples: Millennials Winning With SIPs

From ₹5,000/Month to Lakhs in 10 Years

Take Ayesha, a 28-year-old marketing professional in Karachi. She started investing ₹5,000 per month via SIPs in 2015. Fast forward to 2025, her disciplined investing and market growth have turned her contributions into over ₹10 lakh. No trading, no speculation—just consistent, long-term investing. Her secret? Never skipping a month, even during downturns.

How SIPs Funded a Dream Wedding, House, or Startup

Real-life stories abound of millennials achieving milestones through SIPs.

- Faizan and Hina used their SIP returns to pay for their wedding without debt.

- Ravi, a freelance designer, used his SIP savings to make the down payment on his first home.

- Sara, an entrepreneur, funded the launch of her digital clothing brand using her SIP portfolio, built over six years.

These aren’t just numbers—they’re real wins powered by consistency and smart planning.

Stories From the Smart Investor Tribe

There’s a growing tribe of millennials who proudly call themselves “SIP investors.” They share progress on Reddit, LinkedIn, and financial forums—not to boast, but to inspire others to start small and stay the course. These stories show that financial success isn’t just for the rich—it’s for the disciplined. And in 2025, SIPs continue to be the launchpad.

9. ✅ The Bottom Line: SIPs Still Deliver in 2025

Why SIPs Are More Than Just a Trend

SIPs have stood the test of time—not because they’re trendy, but because they work. While markets shift, apps evolve, and financial fads come and go, SIPs remain a proven, time-tested wealth-building tool. For millennials navigating rising costs, lifestyle inflation, and financial uncertainty, SIPs offer a calm, clear, and consistent path to financial freedom.

What Millennials Should Do Now

The best part? It’s never too late—or too early—to start. Whether you’re 22 and fresh out of college or 35 with a growing family, SIPs can be tailored to your goals and budget. The key is to start small, stay regular, and stay invested. Use the digital tools available, track your goals, and let time and compounding do the rest.

SIP Smart: Tools, Tips & Takeaways

- Start with what you can afford—₹500/month is enough.

- Use goal-based SIPs to stay motivated and track progress.

- Review your funds annually and adjust as needed.

- Don’t panic during market dips—stay the course.

SIPs aren’t just investments—they’re a mindset shift toward long-term thinking, patience, and financial discipline. And in 2025, that mindset is more powerful than ever.

🔄 Bonus: SIP FAQs for First-Time Investors

💰 How Much Should I Start With?

You can begin with as little as ₹500 per month, though many millennials start with ₹1,000–₹5,000 depending on income. The key is starting early and increasing your contribution as your salary grows. Even small amounts, invested regularly, can snowball into big wealth over time.

📅 What If I Miss a SIP Date?

Missing a SIP date occasionally is not the end of the world. Most apps or banks will automatically retry after a few days. However, frequent misses can break your compounding streak. Set up auto-debit from your salary account and maintain a small buffer to avoid this issue.

🔄 Can I Pause or Modify My SIP Later?

Yes, SIPs are flexible. You can pause, increase, decrease, or even switch funds anytime. Most platforms allow these changes online with no penalties. This adaptability is why SIPs are perfect for millennials dealing with variable incomes or shifting life goals.

📈 Are SIPs Risk-Free?

No investment is completely risk-free. SIPs invest in mutual funds, which are market-linked. However, they reduce risk through diversification and rupee cost averaging. Over long durations, SIPs in well-performing funds have historically outperformed fixed deposits and inflation.

🧠 What Type of Funds Should I Choose as a Beginner?

Start with large-cap or balanced hybrid funds, which offer stability and moderate returns. As you learn more and your risk appetite grows, you can explore mid-cap, small-cap, or thematic/ESG funds. Use SIP calculators and fund comparison tools to guide your choices.

Read Also: What Is Your Stock Really Returning? A Look Beyond the Headlines